WebRecon breaks down the decline in TCPA and FDCPA litigation filings as well as complaints to the CFPB.

WebRecon breaks down the decline in TCPA and FDCPA litigation filings as well as complaints to the CFPB.

06/08/2022 2:00 P.M.

2 minute read

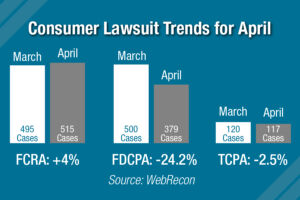

Reversing course from March, WebRecon’s latest report shows litigation declined in Telephone Consumer Protection Act and Fair Debt Collection Practices Act cases, while it increased under the Fair Credit Reporting Act.

FDCPA suits declined 24.2% over March, TCPA suits declined 2.5%, while FCRA cases increased 4%, according to WebRecon.

“This closely follows the (year-to-date) trend so far, with TCPA (-35.2%) and FDCPA (-12.4%) down and FCRA (+6.7%) up, while CFPB complaints (-.7%) are down a sliver,” WebRecon CEO Jack Gordon said in the report.

CFPB complaints declined 2.4% from March to April.

Here is a breakdown of claims under accounts receivable management industry laws as well as CFPB complaints for April.

Fair Debt Collection Practices Act

FDCPA claims declined by 24.2% to 379 compared to 500 in March. Compared to claims from Jan. 1 through April 30, 2021, FDCPA claims declined 12.4% from 2,110 to 1,849 during the same period this year.

Telephone Consumer Protection Act

TCPA claims declined by 2.5% to 117 compared to 120 in March. Compared to claims from Jan. 1 through April 30, 2021, TCPA claims declined 35.2% from 736 to 477 during the same period this year.

Fair Credit Reporting Act

FCRA claims increased by 4% to 515 compared to 495 in March. Compared to claims from Jan. 1 through April 30, 2021, FCRA claims increased 6.7% from 1,834 to 1,956 during the same period this year.

Consumer Financial Protection Bureau Complaints

Consumer complaints filed with the CFPB declined 2.4% from 6,102 in March to 5,953 in April.

There were 5,738 complaints in April 2021 compared to the 5,953 complaints in April this year—a 3.7% increase.

The types of debt behind the complaints were:

- 1,535 Other debt (26%)

- 1,446 I do not know (24%)

- 1,438 Credit card debt (24%)

- 958 Medical debt (16%)

- 265 Auto debt (4%)

- 149 Payday loan debt (3%)

- 72 Mortgage debt (1%)

- 45 Private student loan debt (1%)

- 45 Federal student loan debt (1%)

The most common type of complaint was about attempts to collect debt not owed, at 52% or 3,077 complaints, followed by complaints about written notification about a debt at 22% or 1,334.

Timely CFPB complaint responses from financial services companies continue to come in at a strong rate of 97%, according to the WebRecon report.

If you have executive leadership updates or other member news to share with ACA, contact our communications department at [email protected]. View our publications page for more information and our news submission guidelines here.

WebRecon breaks down the decline in TCPA and FDCPA litigation filings as well as complaints to the CFPB.

WebRecon breaks down the decline in TCPA and FDCPA litigation filings as well as complaints to the CFPB.